It’s your responsibility to collect sales tax from your customers who buy those goods and pay that tax to your state. Resale certificates also apply to parts you purchase to produce goods your business sells.

What Is a Resale Certificate and How to Get One

Written by: Carolyn Young

Carolyn Young has over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Sarah Ruddle

For over 15 years, Sarah Ruddle has been a noteworthy leader in the business and nonprofit world.

Updated on January 3, 2025

If you’re starting a business and plan to sell tangible goods subject to sales tax, you probably know you need to get a state sales tax license. But you may not know that you’ll also need a resale certificate or several of them so you can buy goods without paying sales tax.

This keeps goods from being taxed twice since you’ll collect sales tax from your customers and pay it to your state.

How Does a Resale Certificate Work?

For each vendor you purchase goods from, you’ll need to have a resale certificate from your state, which you will then present to that vendor to avoid paying sales tax on the items you buy (depending on your state’s laws, however, you may still have to pay a use tax).

Keep in mind that you need a separate resale certificate for each vendor. In some states, your sales tax license, a seller’s permit, will serve as your resale certificate for all vendors.

If your business provides taxable services, you’ll need a sales tax license, but not a resale certificate, since resale certificates only apply to goods purchased for resale or manufacturing.

If you purchase goods using your resale license and fail to sell them, you’ll be responsible for the sales tax yourself and could face fines and penalties. In addition, if you use a resale certificate to buy something you do not intend to resell, such as office equipment, that’s tax fraud, a federal offense. Penalties vary by state but could include fines and a jail sentence.

Suppliers and vendors do not have to accept resale certificates. However, they may choose not to do so because the supplier or vendor will be responsible for the sales tax if your certificate is invalid.

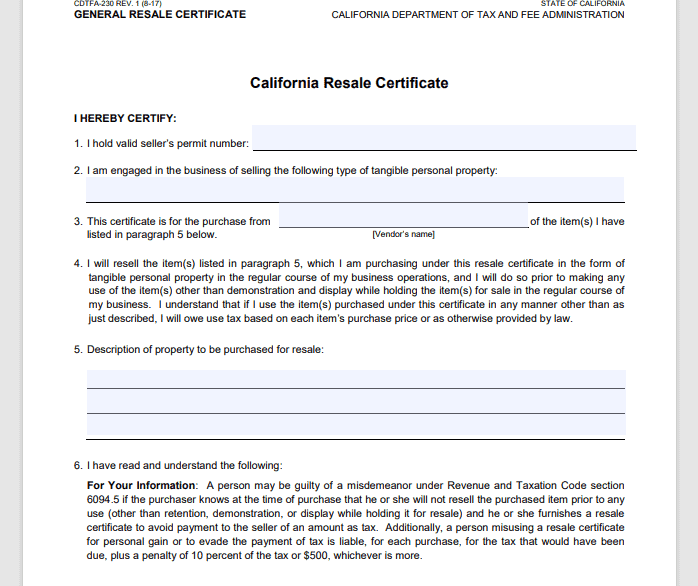

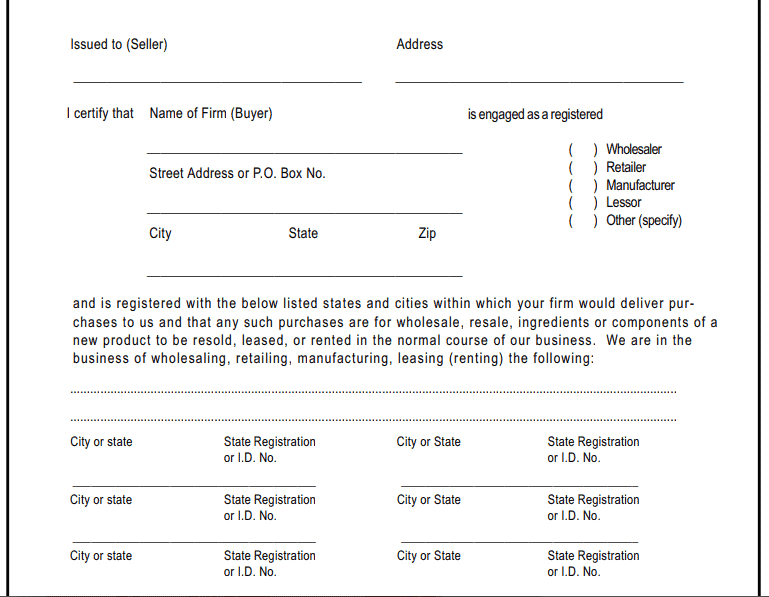

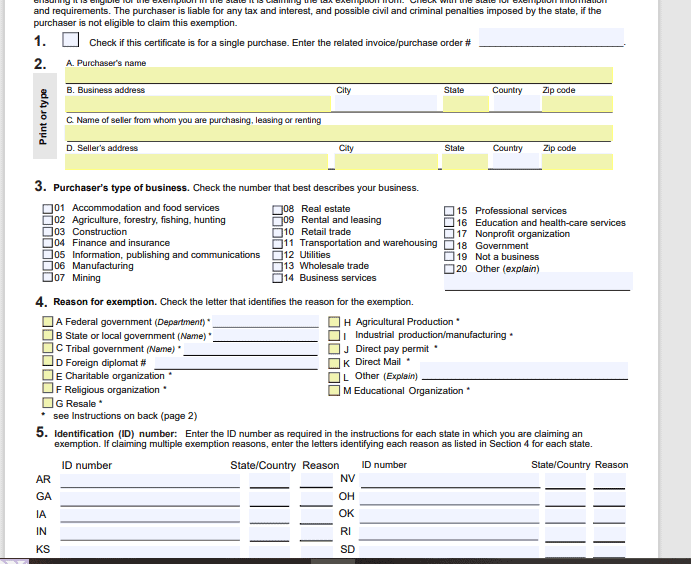

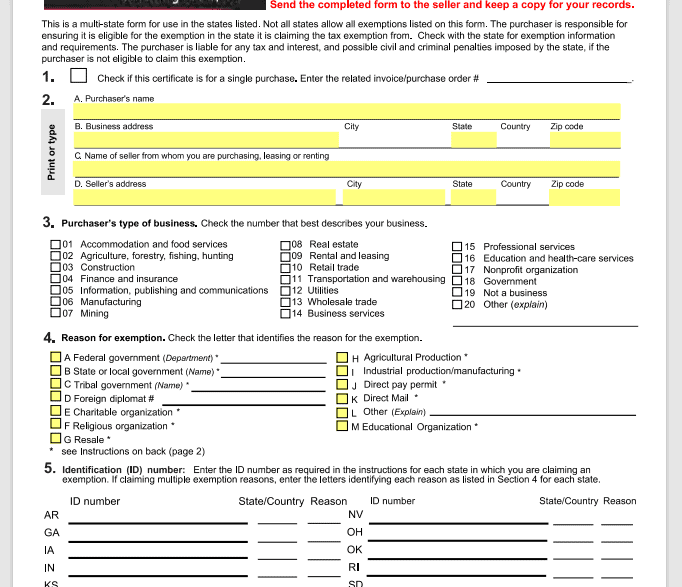

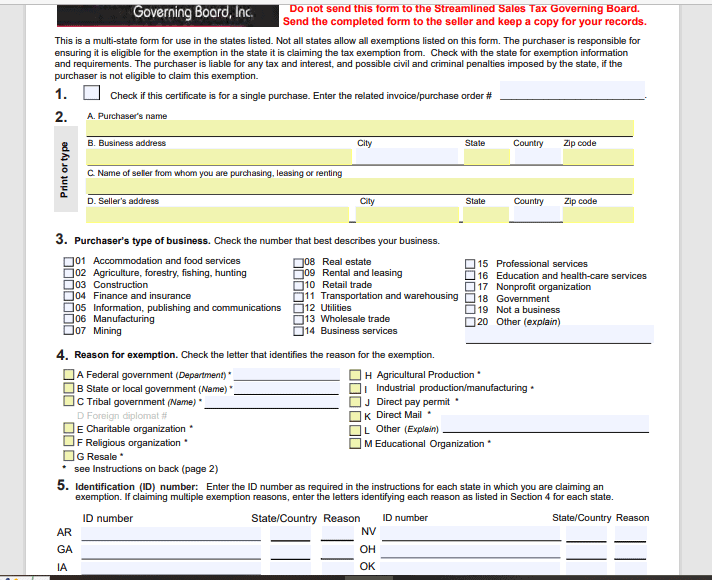

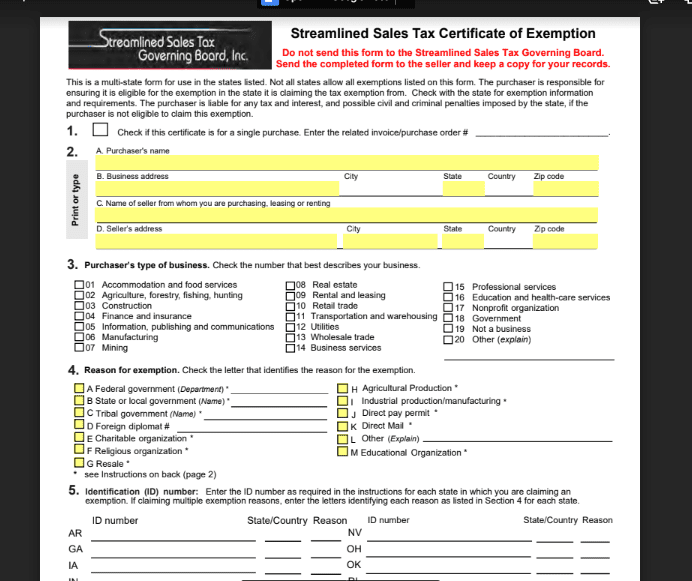

Multi-Jurisdictional Resale Certificates

If you purchase goods in more than one state, you may be able to get a multi-jurisdictional resale certificate to cover multiple suppliers, but not all states accept these. In addition, these certificates can get complicated, so you’ll want to do some homework before you get one.

You can learn more from the Multistate Tax Commission.

How to Get a Resale Certificate

You’ll obtain a resale certificate from your state’s tax department. This must be from the state where you do business, even if you registered your business in another state. You’ll need resale certificates for vendors in every state where you do business.

Alabama

In Alabama, your sales tax permit serves as your resale certificate.

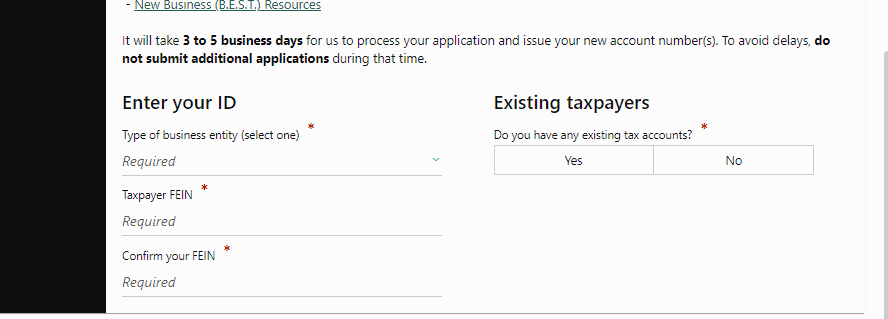

To obtain a sales tax permit, visit the Alabama Department of Revenue website to register for a tax account. You’ll need your federal EIN to get started.

The registration may take about a half hour, as you’ll have to enter detailed information about the products you sell. There is no fee, and you should receive your permit within ten days.

Once you have your sales tax permit, you’ll present it to your vendor. Be sure to keep a copy for your records.

Sales tax permits in Alabama expire after one year, so you’ll need to keep track of the expiration date to renew it on time.

Alaska

Alaska has no state sales tax, but many local jurisdictions have sales tax.

To obtain a resale certificate, contact your local government. Fees and timeframes for obtaining the certificate vary by jurisdiction.

Once you have the certificate, you’ll present it to your vendor. Be sure to keep a copy for your records.

Each local jurisdiction has its resale certificate renewal requirements, so check with your local government again. Generally, the resale certificates need to be renewed annually.

Arizona

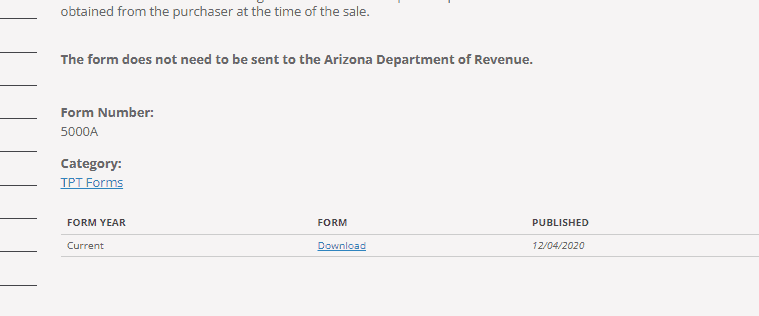

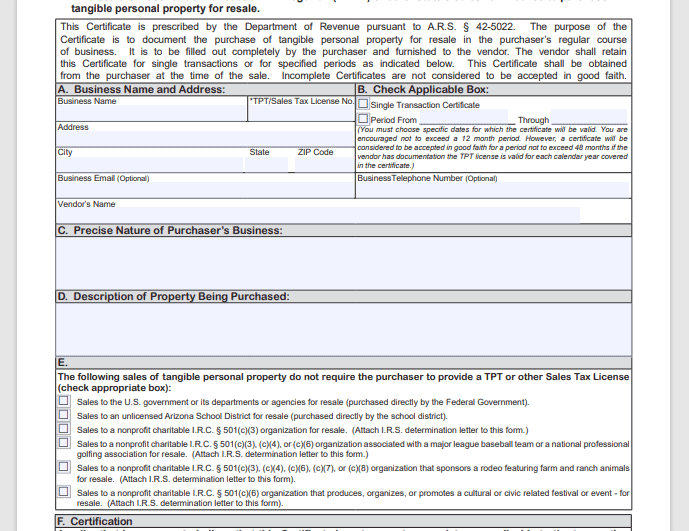

To obtain a resale certificate in Arizona, visit the department of Arizona Department of Revenue website.

You’ll download the form and fill out a copy for each vendor.

In Arizona, obtaining the certificate is free, and you can get it immediately.

Once you have the certificate, present it to your vendor and keep a copy for your records.

In Arizona, the expiration date of the resale certificate depends on the time frame you specified. The form states the following:

You must choose specific dates for which the certificate will be valid. You are encouraged not to exceed a 12-month period. However, a certificate will be considered to be accepted in good faith for a period not to exceed 48 months if the vendor has documentation that the TPT license is valid for each calendar year covered in the certificate.

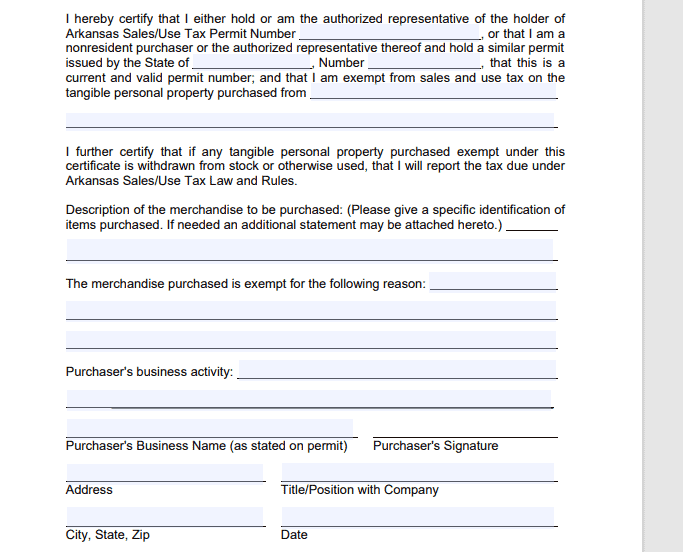

Arkansas

In Arkansas, a resale certificate is called an exemption certificate. To obtain an exemption certificate in Arkansas, you’ll need to visit the Department of Finance and Administration website to download the form.

The exemption certificate is simple to fill out.

In Arkansas, the certificate is free, and once it’s filled out, you can use it immediately.

Once you have the certificate, you’ll present it to your vendor. Be sure to keep a copy for your records.

Exemption certificates in Arkansas expire unless used within 12 months. Otherwise, they do not expire, although it’s often a good idea to update them every few years.

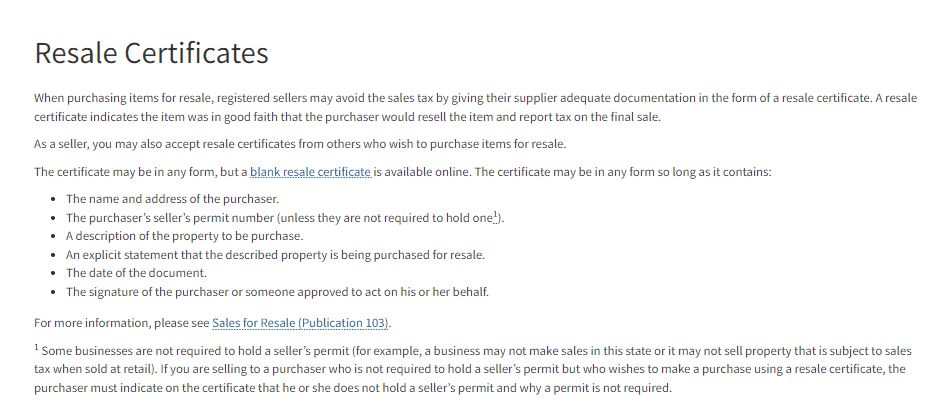

California

To obtain a resale certificate in California, visit the Department of California Tax Service Center website to download the form.

You can create your resale certificate containing the above information or download a blank certificate.

In California, the certificate is free, and once you fill it out, you can use it immediately.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Resale certificates in California do not expire and can only be revoked by the purchaser in writing.

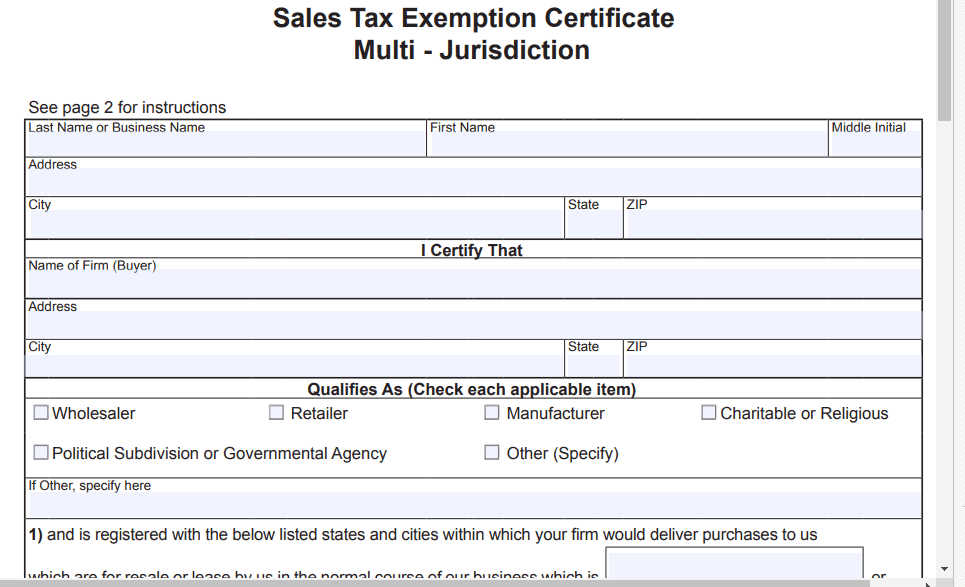

Colorado

To obtain a resale or sales tax exemption certificate in Colorado, you’ll need to visit the Department of Revenue website to download the form.

The certificate is multi-jurisdictional, so you’ll list all the states where you make sales.

In Colorado, obtaining the certificate is free; as soon as you fill it out, you can begin using it.

Once you have the certificate, you’ll present it to your vendor. Be sure to keep a copy for your records.

Most resale certificates in Colorado need to be renewed every two years, and resale certificates are void if you don’t have an active sales tax permit.

Connecticut

To obtain a resale certificate in Connecticut, visit the Department of Revenue website to download the form.

In Connecticut, obtaining the certificate is free; you can use the form as soon as you’ve filled it out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Resale certificates in Connecticut expire after three years, so keep track of expiration dates so you can renew them on time.

Delaware

Delaware does not have state or local sales tax, but if you’re selling goods in other states, you may need to obtain resale certificates in those states.

Florida

In Florida, a resale certificate is automatically issued when you obtain your sales tax permit. It will be a blank form, and you’ll simply fill out copies for each vendor.

You’ll obtain your sales tax permit through the Department of Revenue.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Florida resale certificates expire every year when your sales tax permit expires. You’ll automatically receive a new resale certificate when your sales tax permit is renewed.

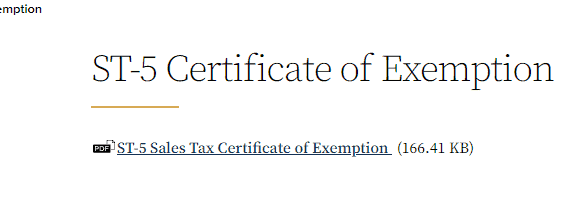

Georgia

To obtain a certificate of exemption in Georgia, visit the Department of Revenue website to download the form.

The form is simple to fill out.

Obtaining the certificate is free; you can use it as soon as you fill it out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Georgia certificates of exemption do not expire, though it’s a good idea to review them every few years to ensure the information is up to date.

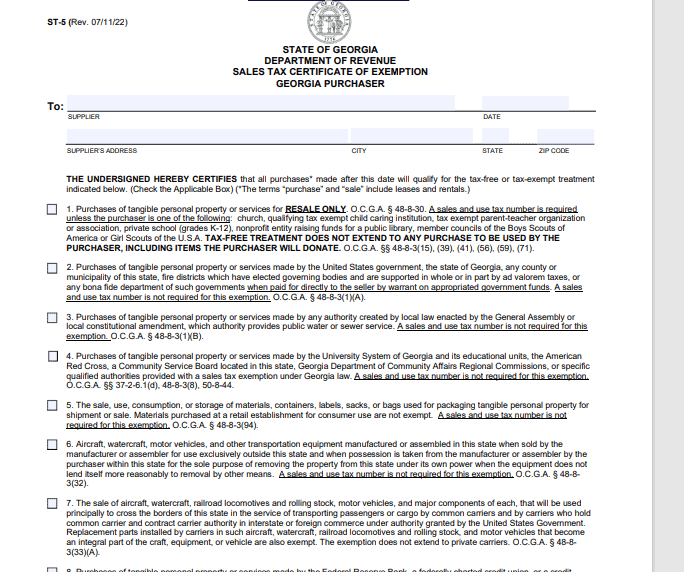

Hawaii

To obtain a resale certificate in Hawaii, visit the Department of Taxation website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Hawaii resale certificates do not expire and can only be revoked in writing by the purchaser of the goods.

Idaho

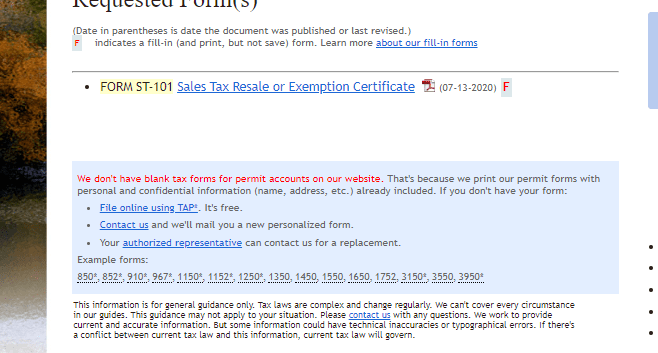

To obtain a resale certificate in Idaho, visit the State Tax Commission website to download the form.

You’ll simply fill out the form for each of your vendors.

Obtaining the certificate is free, and you can begin to use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Resale certificates in Idaho do not expire.

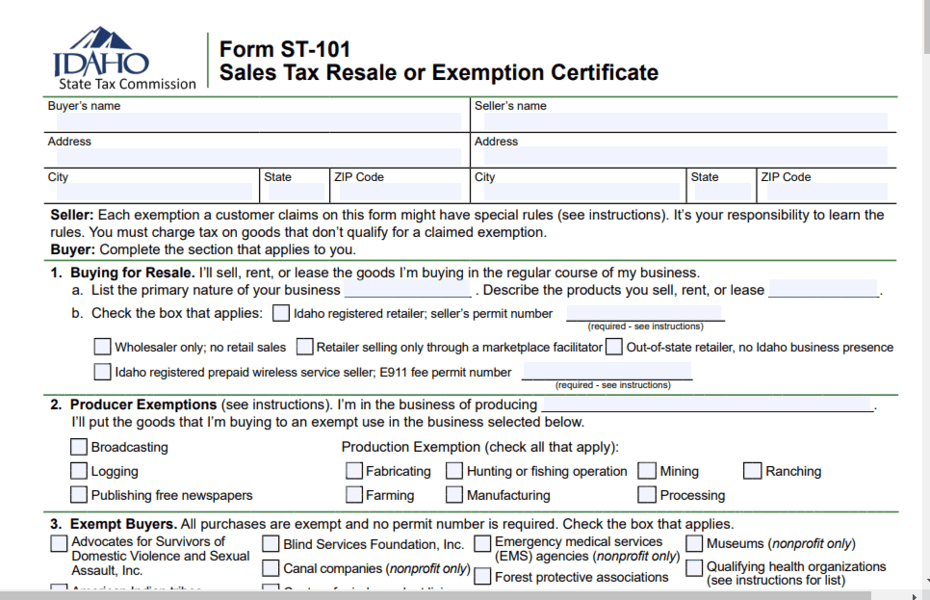

Illinois

To obtain a resale certificate in Illinois, visit the Department of Revenue website to download the form.

Obtaining the certificate is free, and you can use the form as soon as it’s completed.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Illinois resale certificates do not expire, but it’s recommended that you review the certificates every three years to make sure the information is current.

Indiana

To obtain a resale or sales tax exemption certificate in Indiana, visit the Department of Revenue website to download the form.

You’ll fill out a form for each of your vendors.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Resale certificates do not expire unless it’s specified on the form that the certificate is for a single purchase.

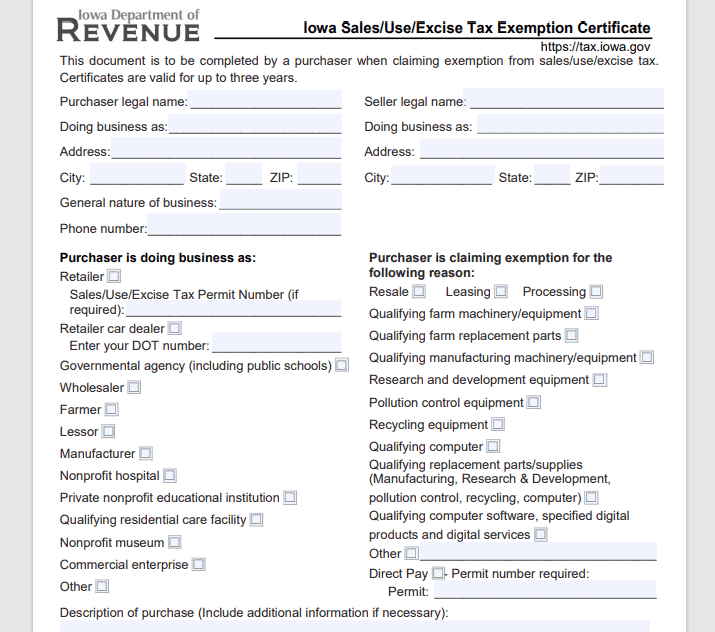

Iowa

To obtain a resale or sales tax exemption certificate in Iowa, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Iowa sales tax exemption certificates expire after three years. However, before the expiration date, you need to download a new blank certificate and fill it out with all the current information.

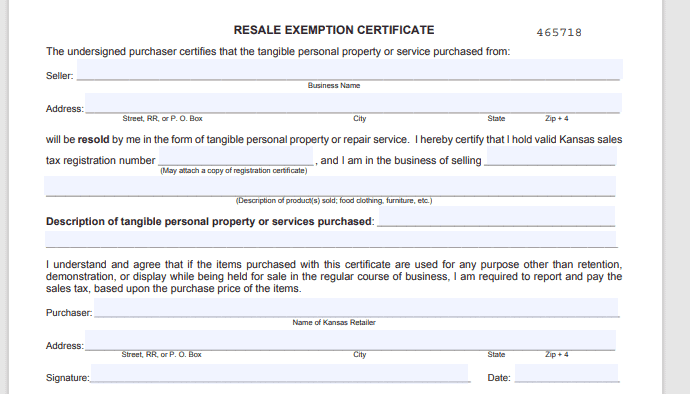

Kansas

To obtain a resale certificate, known as a resale exemption certificate in Kansas, visit the Department of Revenue website to download the form.

Obtaining the certificate is free, and you can begin to use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Kansas resale exemption certificates only need to be renewed if more than one year takes place between transactions with the seller. Therefore, you’ll want to keep track of your purchase dates to know when you need to update your certificates. Then, to renew, you’ll simply need to complete a new certificate and present it to the vendor.

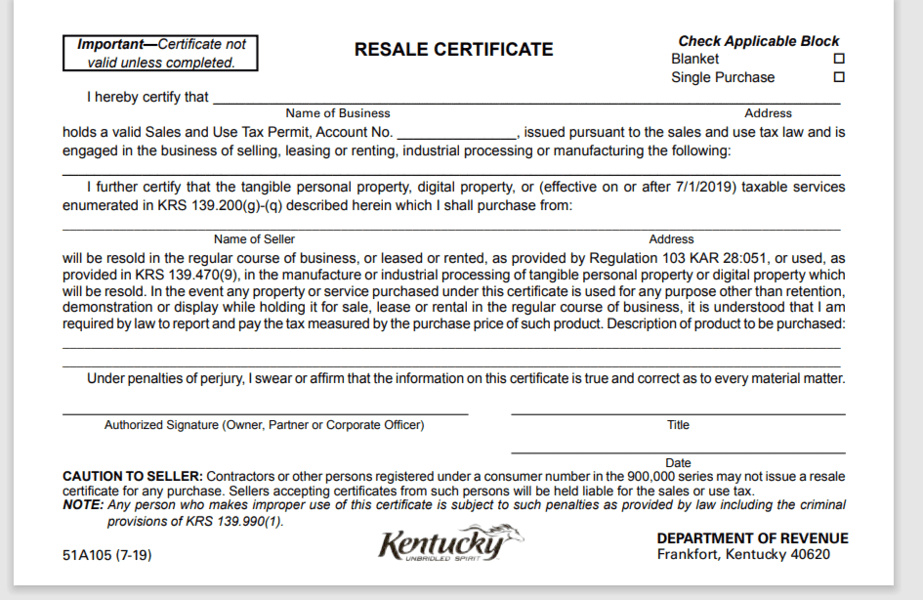

Kentucky

To obtain a resale certificate in Kentucky, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Kentucky resale certificates do not expire, but the state recommends that you review them every four years to make sure that all the information is up to date.

Louisiana

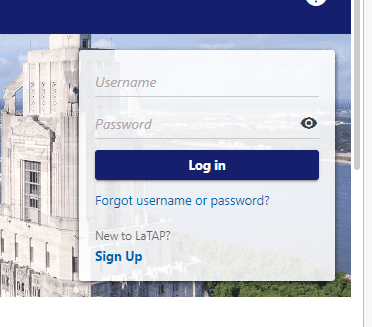

To obtain a resale certificate in Louisiana, visit the Department of Revenue’s business services website.

Louisiana is one of the few states where you have to file your resale certificates with the state, so you’ll need to follow the application process for each vendor.

You’ll need to log in to your account on the site to fill out the application.

You’ll need the following information:

- The physical and mailing addresses of all your business locations

- The sales tax account numbers and NAICS code for all your business locations

- Your business’s resale inventory purchase amounts for the last two years

Once you fill out the form with the required information, you’ll apply.

Obtaining the certificate is free, and it should be filed and ready to print within two to three days.

Once you have the filed certificate, present it to your vendor and keep a copy for your records.

When your resale certificate has been filed, you’ll be notified of its expiration date; however, your certificates will be renewed automatically as long as your business’s taxes, required filings, and reports of in-state sales are up to date.

Suppose a resale certificate does not automatically renew due to late tax payments or report filings. You’ll have 60 days from the expiration date to apply for renewal through your account on the Department of Revenue’s business services website.

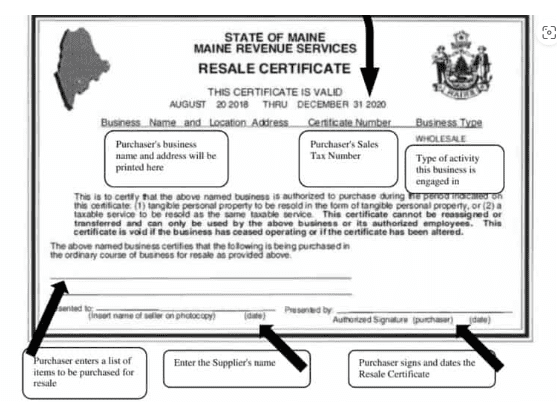

Maine

Maine is slightly different from other states because you must project that you’ll earn $3,000 or more annually to be eligible for a resale certificate.

When you register for your sales tax license, you’ll fill in your projected income, and if that amount is more than $3,000, you’ll automatically be issued a resale certificate.

You’ll register for your sales tax license with the Department of Revenue Services.

The resale certificate that you will be issued looks like this sample:

Obtaining the certificate is free; you’ll receive it immediately if you qualify.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Per the Revenue Services website:

Whether Resale Certificates are renewed depends on a review performed by Maine Revenue Services before the certificate expires. Those active retailers who have reported $3,000 or more in gross sales over the previous 12 months will have their Resale Certificate automatically renewed.

Each renewed Resale Certificate will be valid for four calendar years and expire on December 31st of the fourth year from the date of issuance. Retailers who do not meet the $3,000 gross sales threshold will not be eligible to receive a renewal of their Resale Certificate.

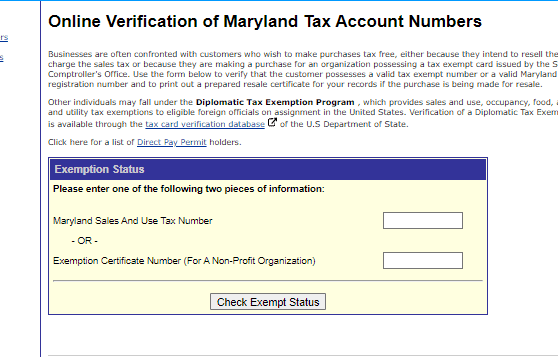

Maryland

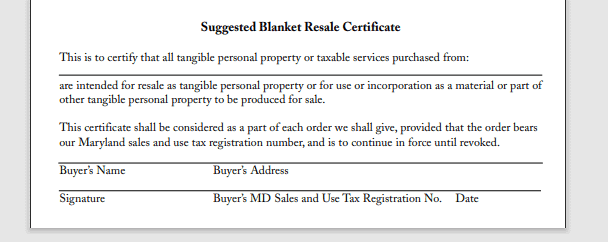

You have a few options to obtain a resale certificate in Maryland. Maryland does not have a specific form, so one option is to create your own.

It must contain the buyer’s name, business address, Maryland sales and use tax registration number, and a signed statement indicating that the purchase of tangible property or taxable service is intended for resale or will be incorporated into a product or service for sale.

Alternatively, you can use a tool offered on the Maryland Comptroller’s website to generate a resale certificate.

Your third option is to use this blanket resale certificate for all purchases from each vendor.

All the options are free, and you can use the certificates as soon as they are filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Maryland resale certificates do not expire, but the state recommends that you review them every three years to ensure all information is up to date.

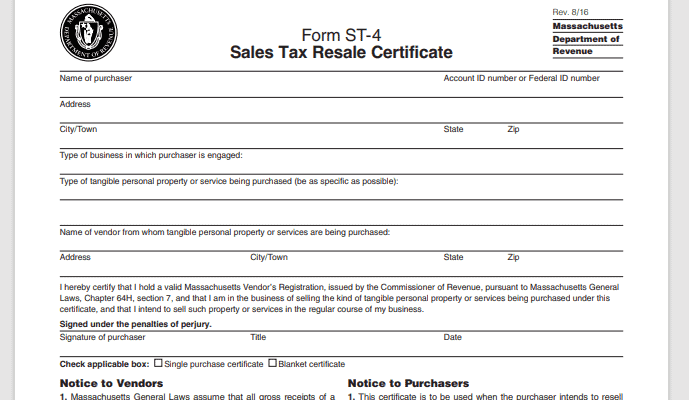

Massachusetts

To obtain a resale certificate in Massachusetts, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Massachusetts resale certificates do not expire.

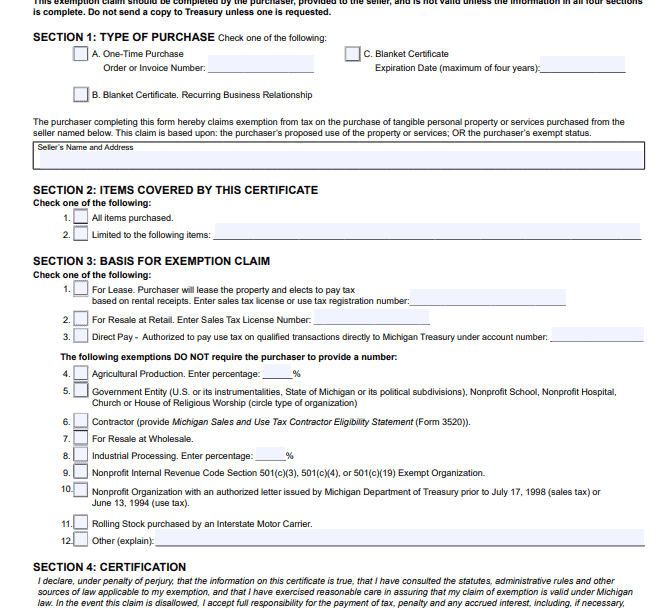

Michigan

To obtain a resale certificate, known as a certificate of sales and use tax exemption in Michigan, visit the Department of the Treasury website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

You can choose a blanket certificate on the form above with an expiration date, which means that date applies (maximum four years). A blanket certificate with an expiration should be used when there may be more than 12 months between sales transactions.

This is best when the purchaser and seller anticipate more than one exempt transaction before the expiration date but have yet to have a recurring business relationship.

Suppose you chose a blanket certificate for a recurring business relationship, meaning when not more than 12 months elapse between sales transactions between the seller and purchaser, you do not need to renew this blanket exemption as long as the recurring business relationship exists.

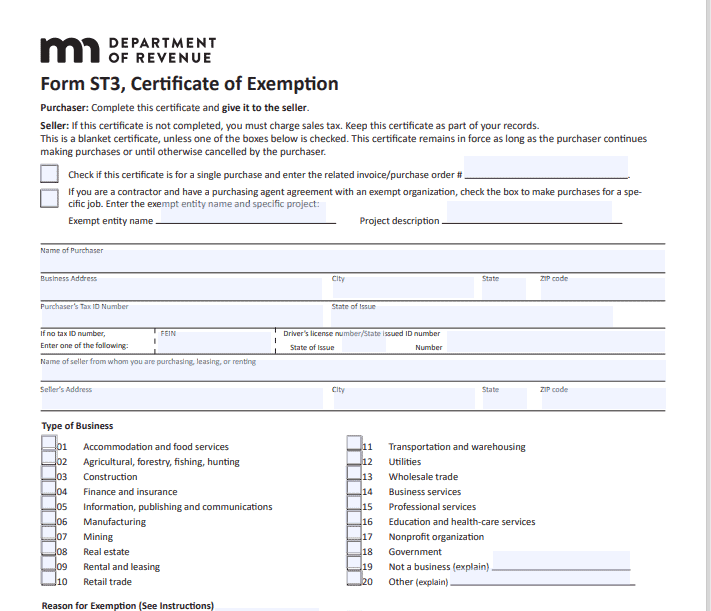

Minnesota

To obtain a resale certificate, known as a certificate of exemption in Minnesota, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Minnesota exemption certificates do not expire unless the information on the changes, so it’s advisable to review and update them periodically.

Mississippi

Again, your sales tax permit will serve as your resale certificate. To obtain your sales tax permit in Mississippi, visit the Department of Revenue website to register for a tax account.

There is no fee for registration.

Once you have your sales tax permit, present a copy to your vendor and keep a copy for your records.

In Mississippi, sales tax permits do not expire, so you can continue to use a copy as your resale certificate as long as you’re in business.

Missouri

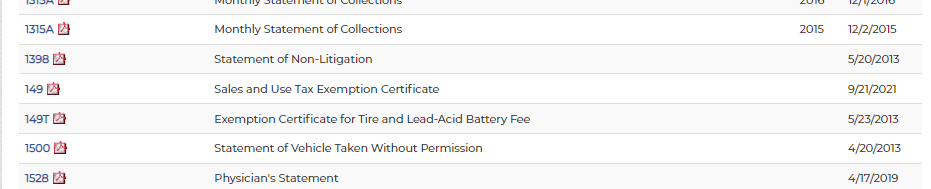

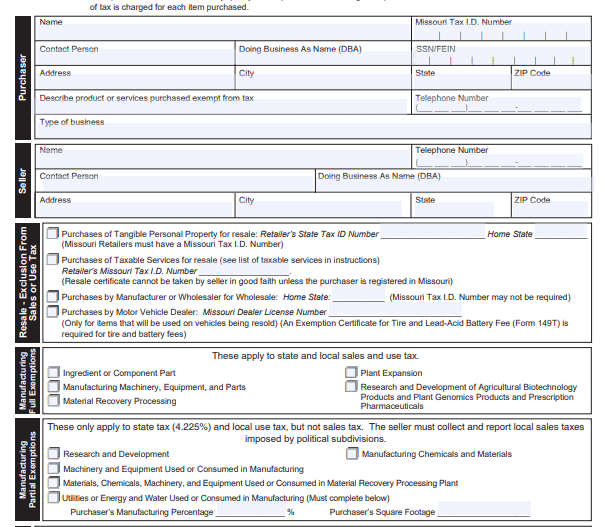

To obtain a resale or exemption certificate in Missouri, visit the Department of Revenue website to download the form.

Choose sales and use a tax exemption certificate and download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Missouri exemption certificates expire after five years. To renew, you’ll simply download the form and fill it out again to present to your vendor.

Montana

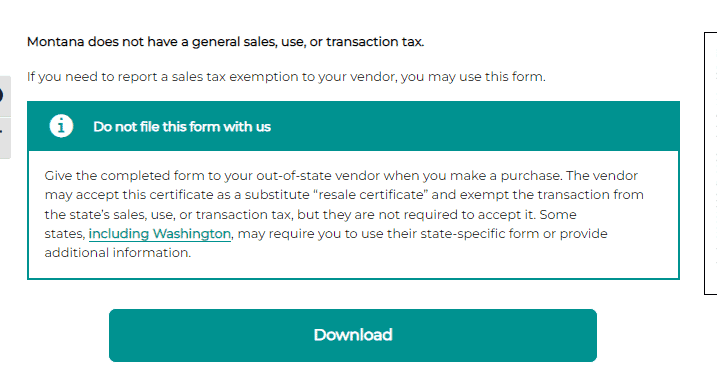

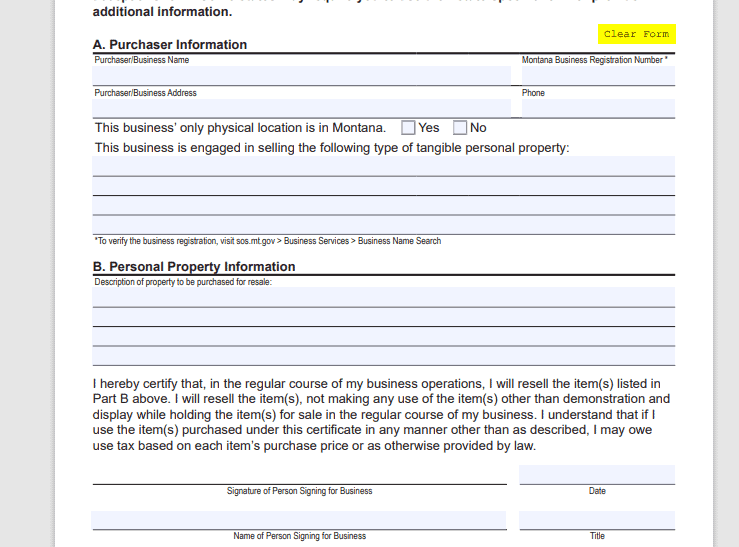

To obtain a resale certificate in Montana, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Montana resale certificates do not expire. It’s a good idea to review them every few years to ensure all the information is up to date.

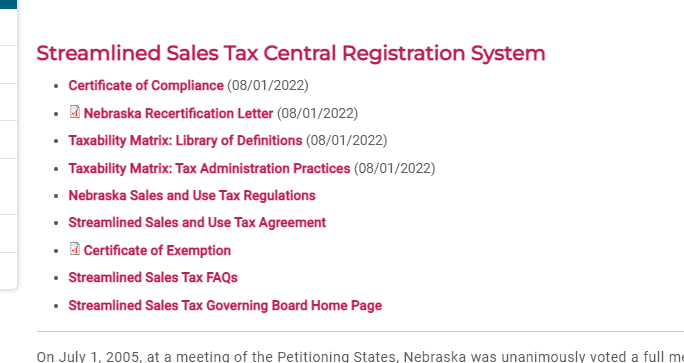

Nebraska

To obtain a resale certificate, known as a certificate of exemption in Nebraska, visit the Department of Revenue website to download the form.

Select the certificate of exemption, download the form, and fill in all the information.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Nebraska exemption certificates do not expire as long as at least one transaction occurs every 12 months.

Nevada

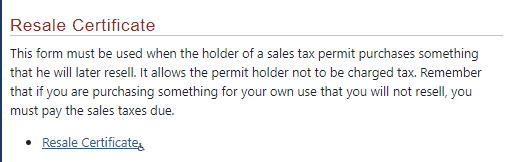

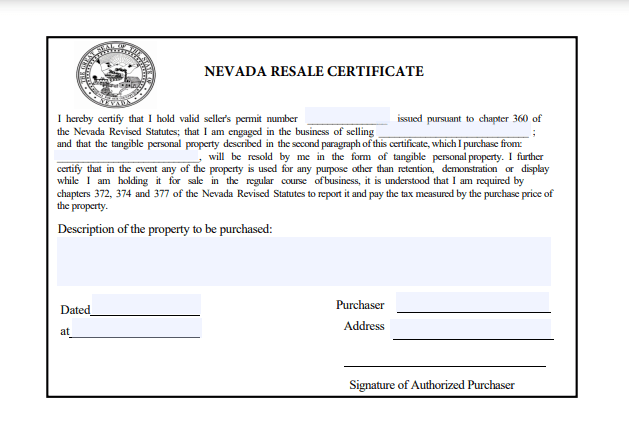

To obtain a resale certificate in Nevada, visit the Department of Taxation website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Nevada resale certificates expire every five years. To renew, simply download the form again, fill it out, and present it to your vendor.

New Hampshire

New Hampshire does not have state or local sales tax, but if you’re selling goods in other states, you may need to obtain resale certificates in those states.

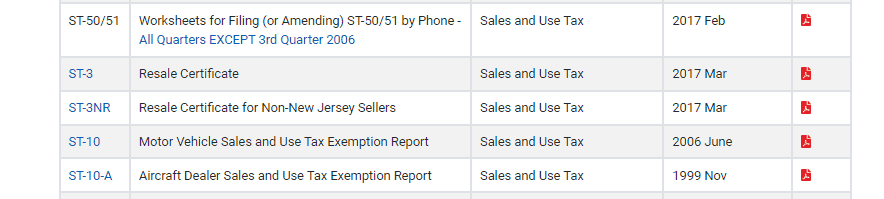

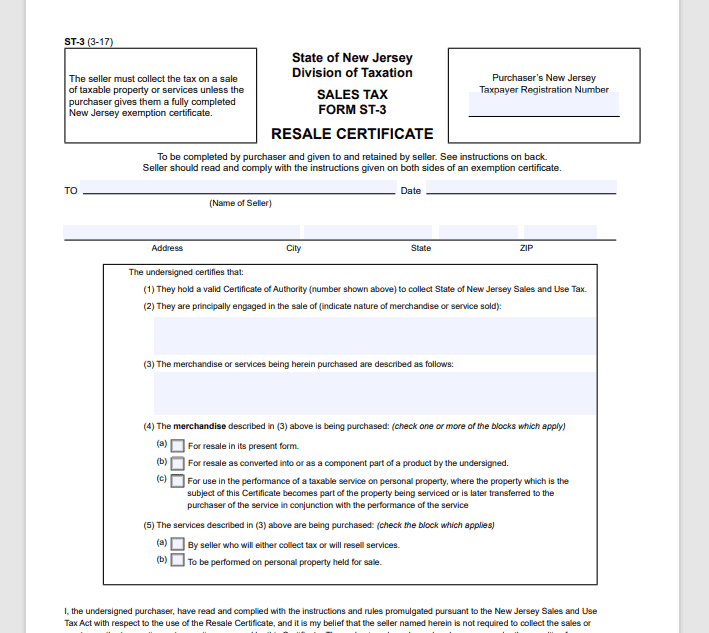

New Jersey

To obtain a resale certificate in New Jersey, visit the Division of Taxation website to download the form.

Obtaining the certificate is free; you can use it as soon as the form is filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

New Jersey resale certificates only expire if the information on the changes. Therefore, reviewing them periodically is a good idea to ensure the information is updated.

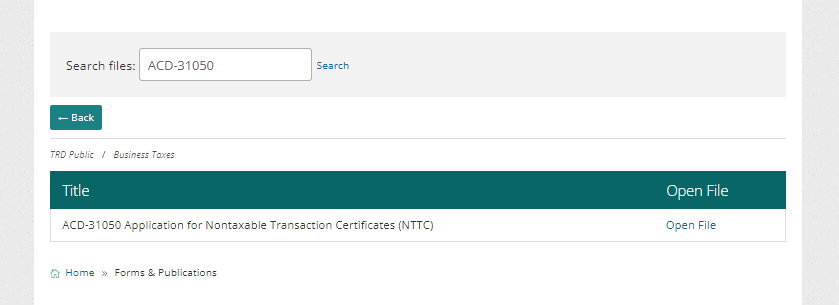

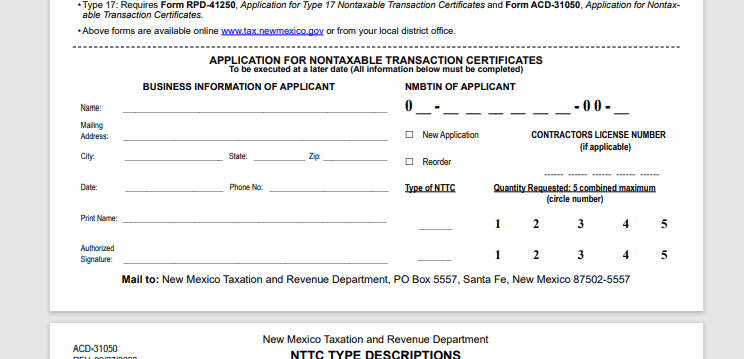

New Mexico

To obtain a resale or non-taxable transaction certificate in New Mexico, visit the Department of Taxation and Revenue website to download the form.

Search for form ACD-31050 and then open the file to download the form.

You’ll need to mail the application to:

New Mexico Taxation and Revenue Department

PO Box 5557

Santa Fe, New Mexico 87502-5557

The certificate is free, and you should receive it within seven days.

Once you have the certificate, present it to your vendor and keep a copy for your records.

New Mexico’s non-taxable transaction certificates do not expire. Therefore, reviewing them every few years is a good idea to ensure the information is up to date.

In New Mexico, the penalty for tax fraud is repayment of the tax owed plus interest and penalties and possibly a $10,000 fine and nine years in prison.

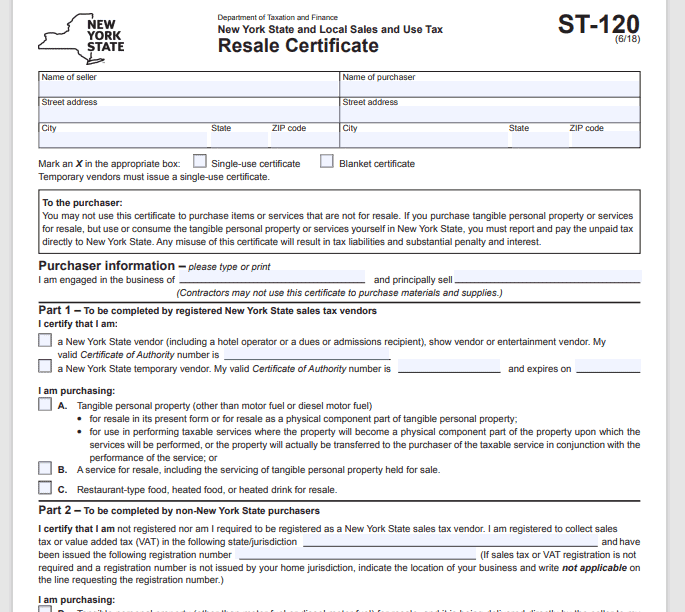

New York

To obtain a resale certificate in New York, visit the Department of Taxation website to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Resale certificates in New York do not expire. It’s a good idea to review them every few years to ensure the information is up to date.

North Carolina

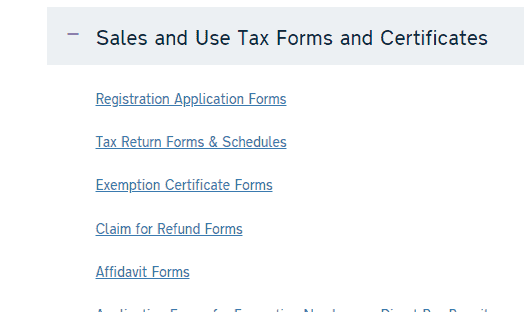

To obtain a resale certificate, known as an exemption certificate in North Carolina, visit the Department of Revenue website to download the form.

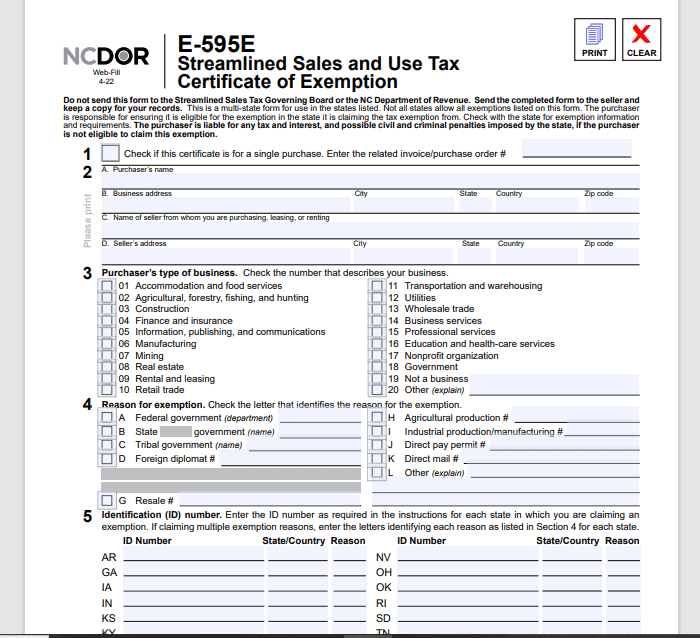

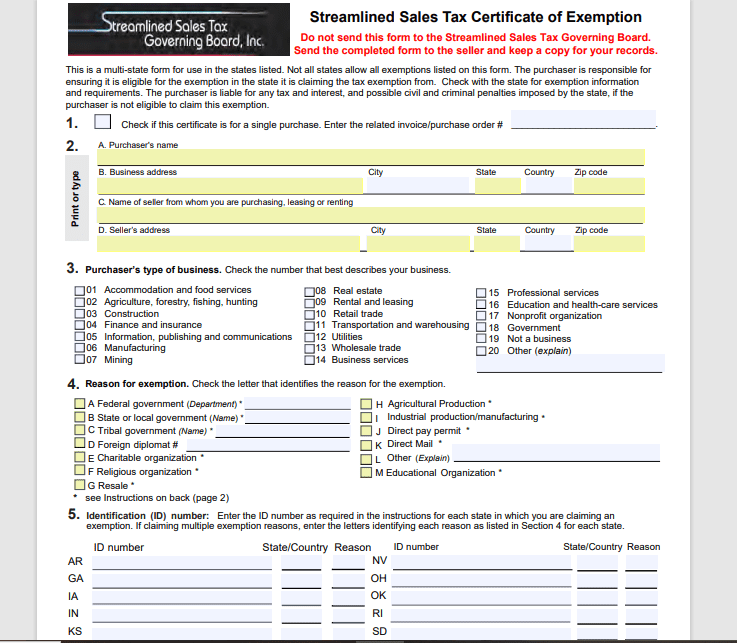

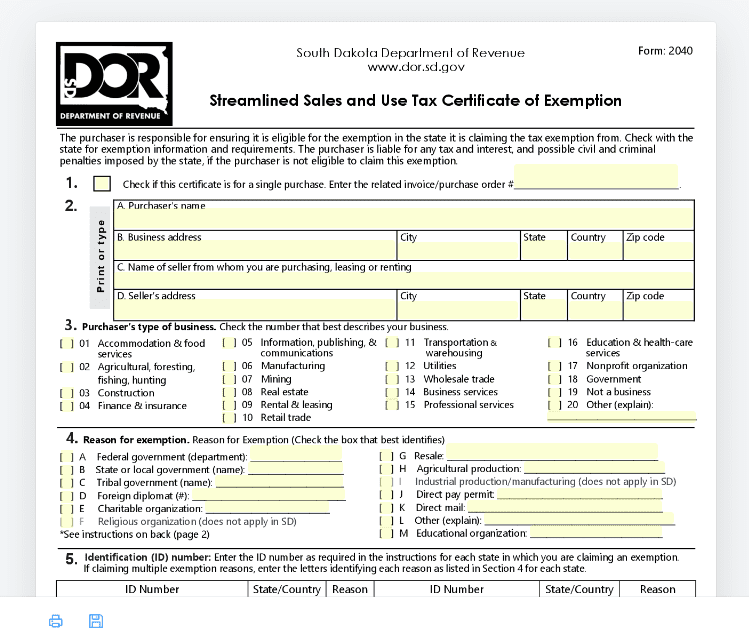

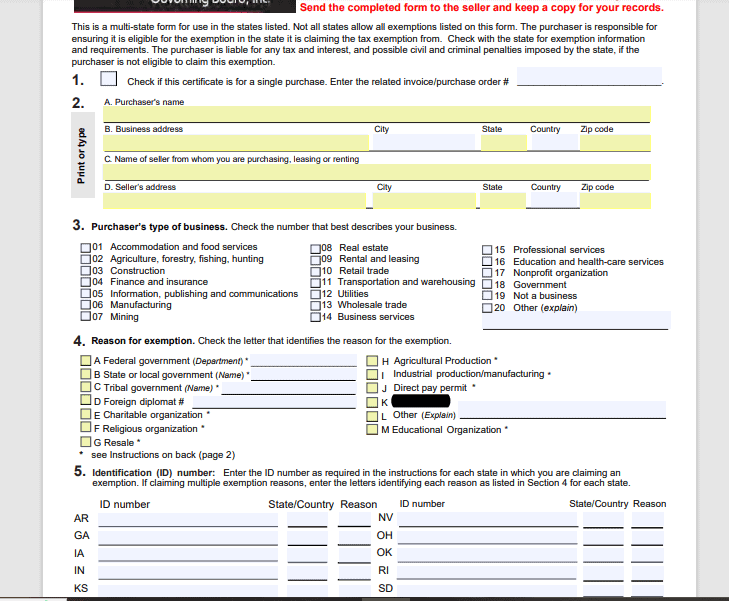

Select exemption certificate forms and download the Streamlined Sales and Use Tax Certificate of Exemption form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

North Carolina exemption certificates do not expire as long as one transaction is made in 12 months.

North Dakota

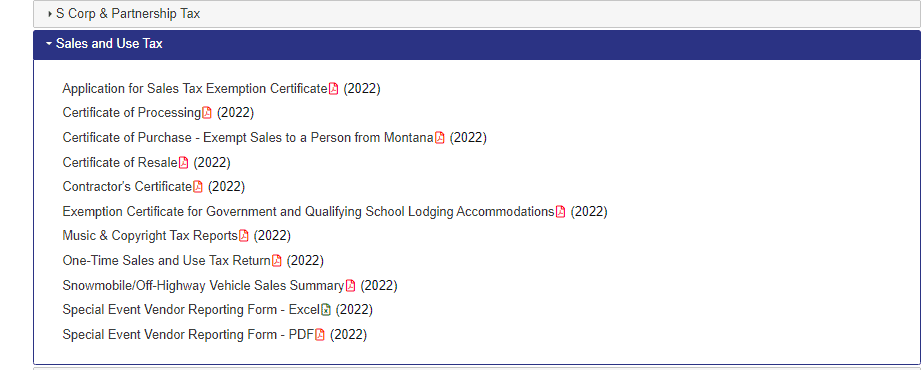

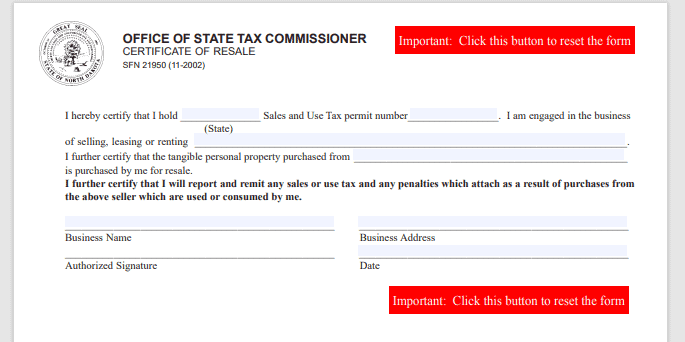

To obtain a resale certificate in North Dakota, visit the Department of Taxation website. You’ll scroll down to sales and use tax forms, then select certificate of resale.

You can fill out the form online and print it.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

North Dakota resale certificates do not expire. It’s a good idea to review them every few years to ensure all the information is up to date.

Ohio

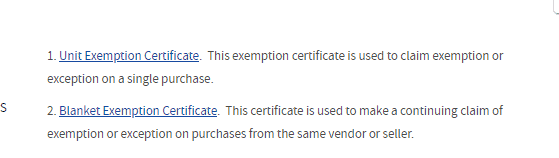

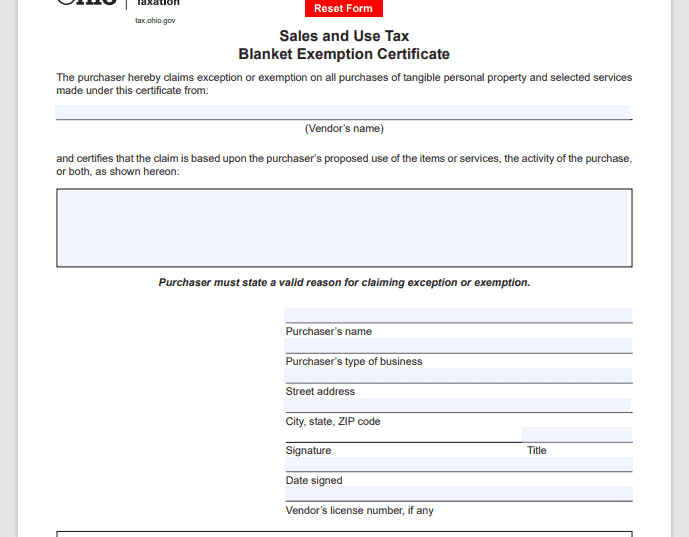

To obtain a resale certificate, known as an exemption certificate in Ohio, visit the Department of Taxation website. You can download either a unit exemption certificate if you’re only making one purchase from a vendor or a blank exemption certificate if you are going to make ongoing purchases from a vendor.

You’ll simply download the form you need and fill it out.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Ohio exemption certificates do not expire. It’s advisable, however, to review them every few years to ensure the information is up to date.

Oklahoma

To obtain a resale certificate, known as a certificate of exemption in Oklahoma, visit the Tax Commission website and download the streamlined certificate of exemption form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Oklahoma exemption certificates do not expire. It’s a good idea to review them every few years to ensure the information is up to date.

Oregon

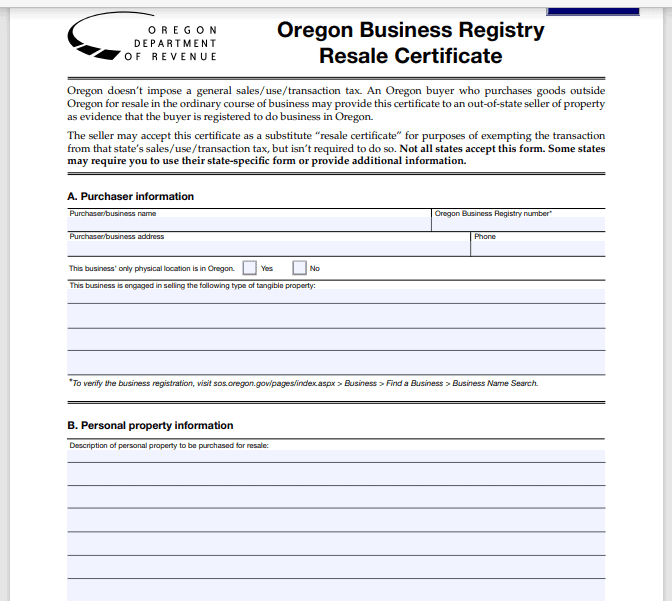

To obtain a resale certificate in Oregon, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Oregon resale certificates do not expire unless the information on the changes. Therefore, reviewing them every few years is a good idea to ensure the information is up to date.

Pennsylvania

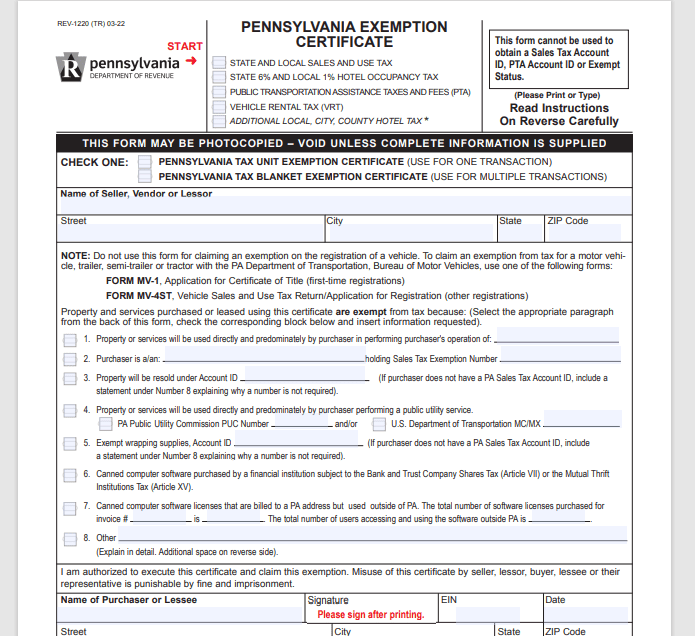

To obtain a resale certificate, known as an exemption certificate in Pennsylvania, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Pennsylvania exemption certificates do not expire. It’s a good idea to review them every few years to ensure the information is up to date.

Rhode Island

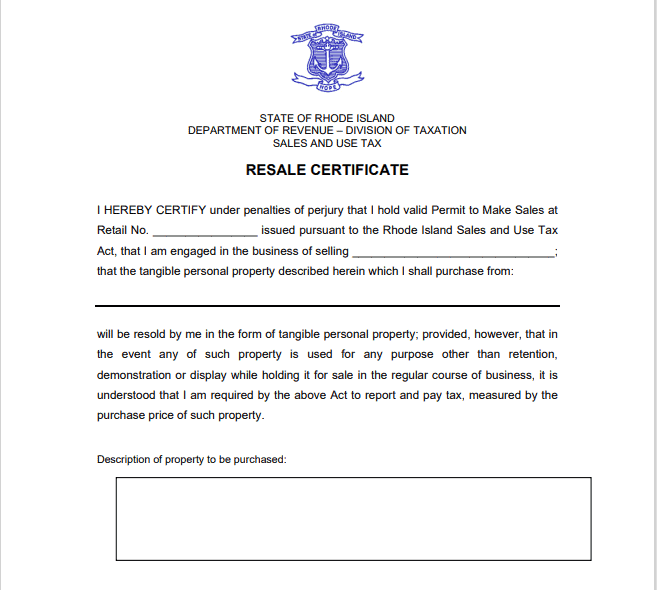

To obtain a resale certificate in Rhode Island, visit the Division of Taxation website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Rhode Island resale certificates expire after four years. To renew them, you must fill out a new form and present it to your vendor.

South Carolina

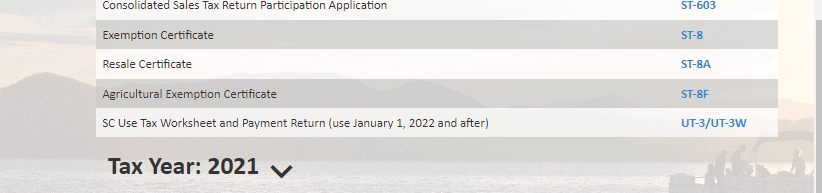

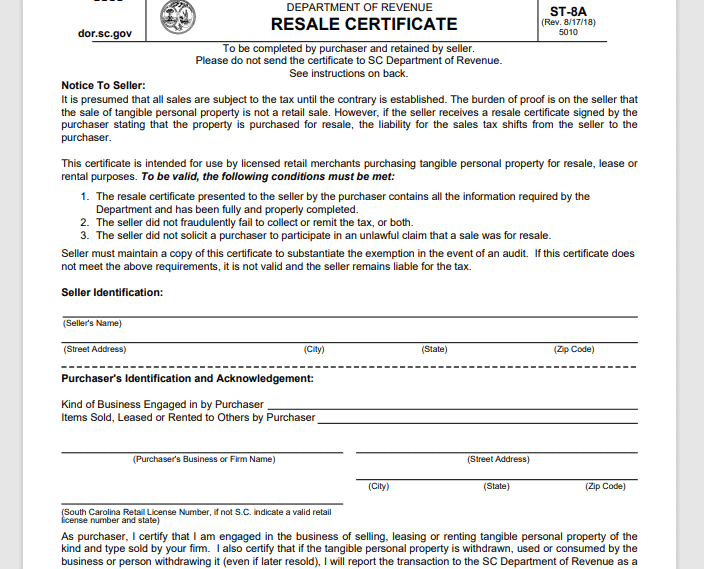

To obtain a resale certificate in South Carolina, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

South Carolina resale certificates do not expire as long as the business is still operating. It’s advisable, though, to review them every few years to ensure the information is up to date.

South Dakota

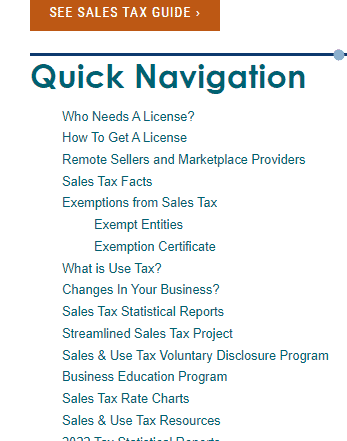

To obtain a resale certificate, known as an exemption certificate in South Dakota, visit the Department of Revenue website to download the form.

Select “exemption certificate” and follow the navigation to complete the form.

You’ll then simply print the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

South Dakota exemption certificates only expire if the information on the changes. Therefore, reviewing them every few years is a good idea to ensure the information is up to date.

Tennessee

To obtain a resale certificate, known as a Government Certificate of Exemption in Tennessee, visit the sales and use tax section of the Department of Revenue website. Choose the streamlined sales and use tax certificate of exemption and download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Tennessee resale certificates do not expire as long as at least one purchase is made every 12 months. You should review them every few years to ensure the information is up to date.

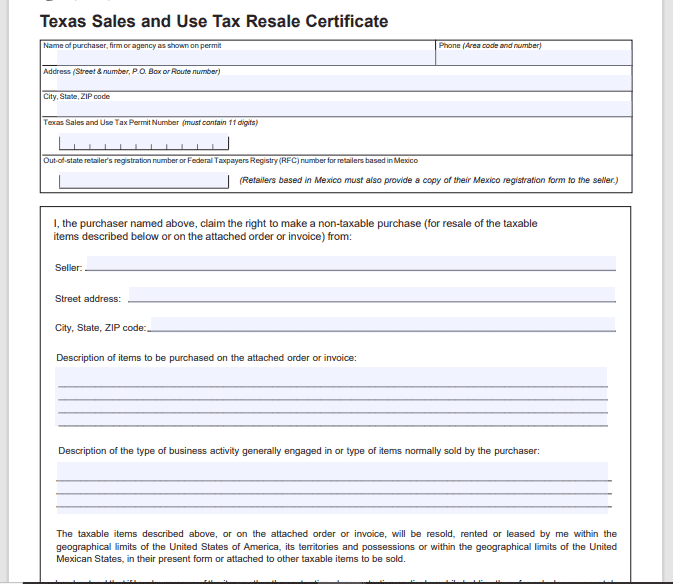

Texas

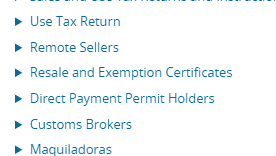

To obtain a resale certificate in Texas, visit the Comptroller’s website to download the form. Then, click on “Resale and Exemption Certificates.” A certificate is also provided in Spanish.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Texas resale certificates only expire if the buyer’s information has stayed the same. It’s a good idea to review them every few years to ensure the information is up to date.

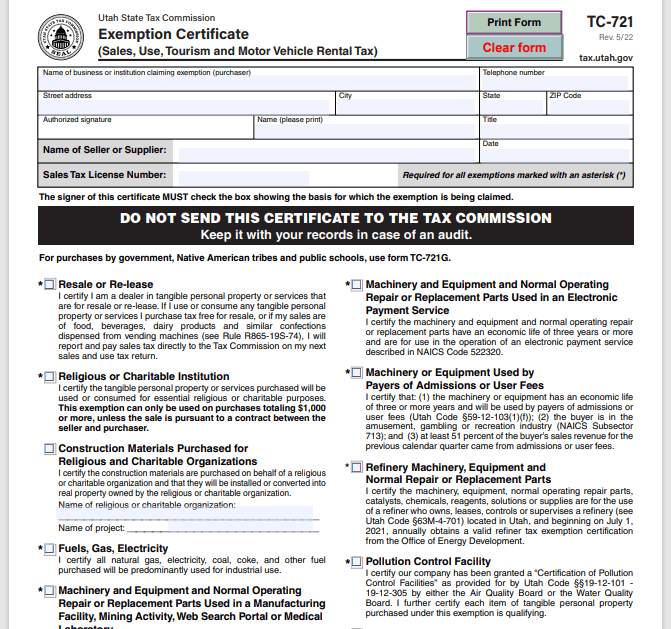

Utah

To obtain a resale certificate, known as an exemption certificate in Utah, visit the Tax Commission’s website to download the form.

Obtaining the certificate is free; you can use it as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Utah exemption certificates do not expire as long as one purchase from the vendor occurs within 12 months. Therefore, you should keep track of purchase dates to maintain your current certificates.

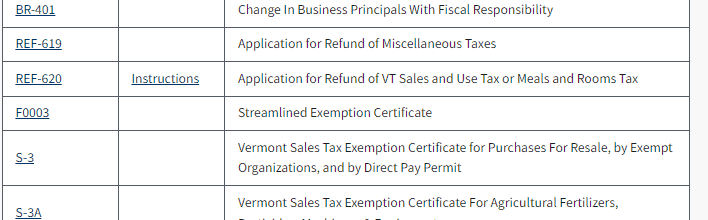

Vermont

Visit the Department of Taxes website to obtain a resale certificate, known as an exemption certificate in Vermont. You’ll select “streamlined exemption certificate” to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Vermont exemption certificates do not expire, but the user must keep all information on file for three years. It’s advisable, however, to review them every few years to ensure the information is up to date.

Virginia

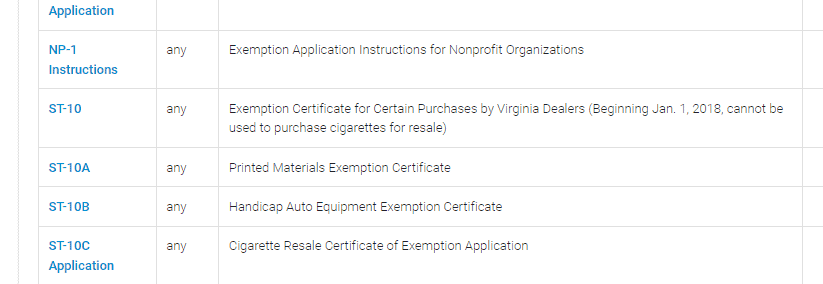

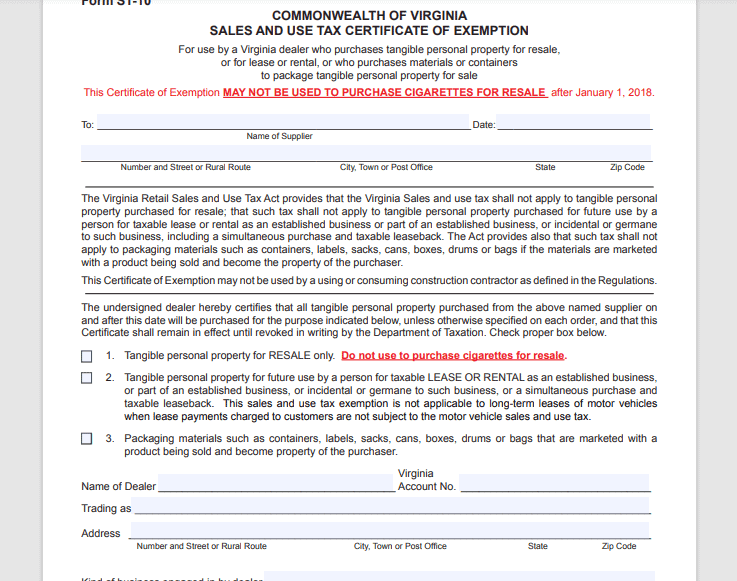

To obtain a resale certificate, known as a certificate of exemption in Virginia, visit the Department of Taxation website. Then, select form ST-10 to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Virginia exemption certificates do not expire. It’s a good idea to review them every few years to ensure the information is up to date.

Washington

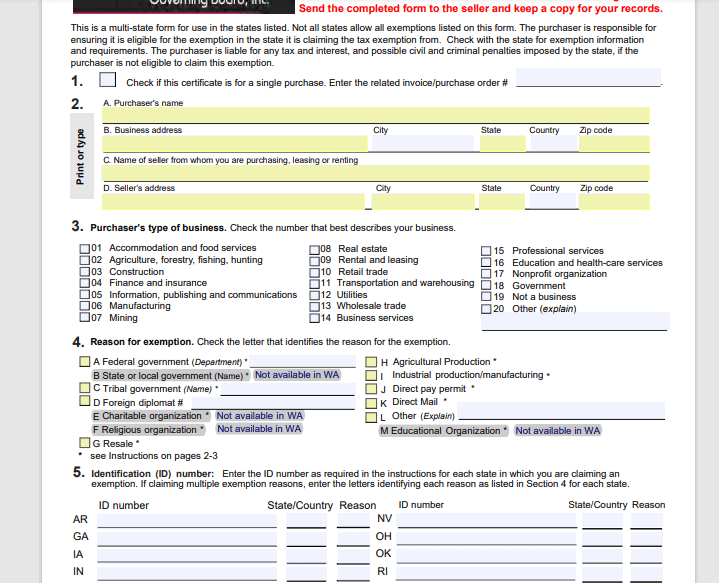

To obtain a resale certificate, known as an exemption certificate in Washington, visit the Department of Revenue website to download the form.

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Washington exemption certificates generally expire after four years. Certificates are only valid for two years if any of the following apply:

- The business is less than 12 months old

- You haven’t reported income within the last 12 months

- The business wasn’t active at the time you received your certificate was received

- You haven’t filed tax returns in the previous 12 months

- You are a contractor

To renew a certificate, you must complete a new one and present it to your vendor.

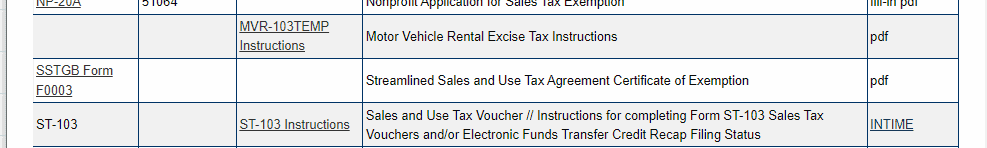

West Virginia

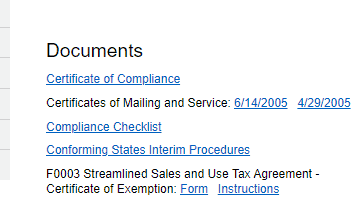

Visit the Tax Division website to obtain a resale certificate in West Virginia. Under documents, select “F0003 Streamlined Sales and Use Tax Agreement – Certificate of Exemption” to download the form.

Obtaining the certificate is $30, and you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Unless you specified on the form that the certificate was for a single purchase, the certificate would only expire if you purchased from the vendor in 12 months. But keep track of your purchase dates to ensure your certificates are up to date.

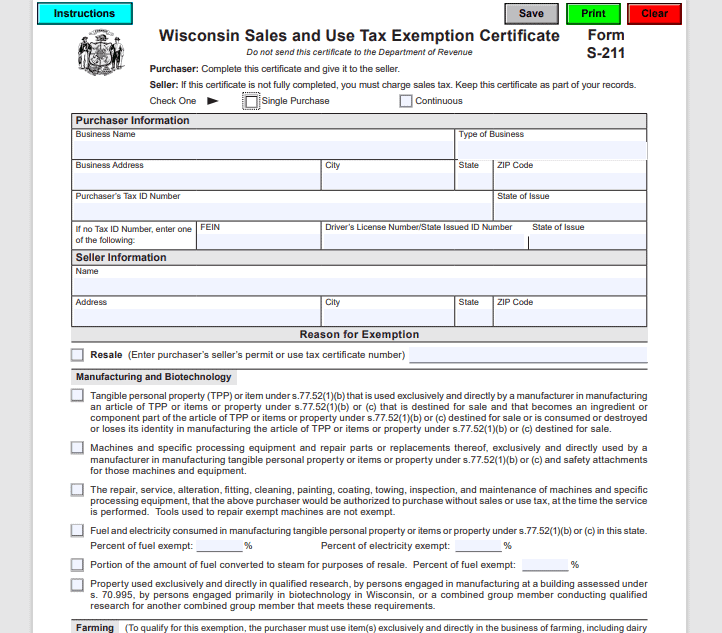

Wisconsin

To obtain a resale certificate, known as an exemption certificate in Wisconsin, visit the Department of Revenue website to download the form.

Obtaining the certificate costs $20, and you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Wisconsin resale certificates do not expire. It’s a good idea to review them every few years to ensure the information is up to date.

Wyoming

A resale certificate can be downloaded from the Wyoming Department of Revenue Excise Tax Division by selecting “Exemption Certificate.”

Obtaining the certificate is free; you can use the form as soon as it’s filled out.

Once you have the certificate, present it to your vendor and keep a copy for your records.

Wyoming resale certificates do not expire. It’s a good idea to review the certificates every few years to ensure the information is up to date.